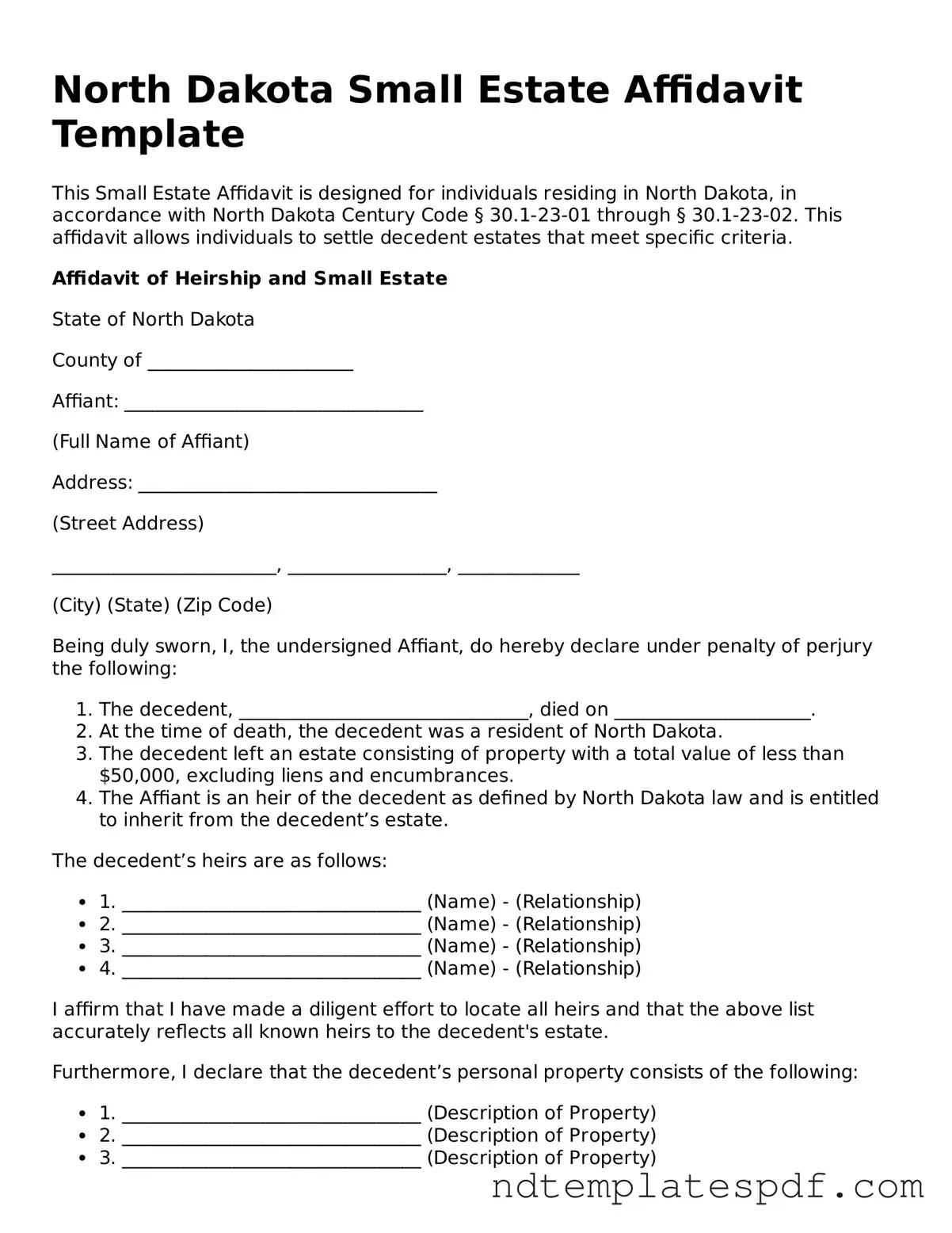

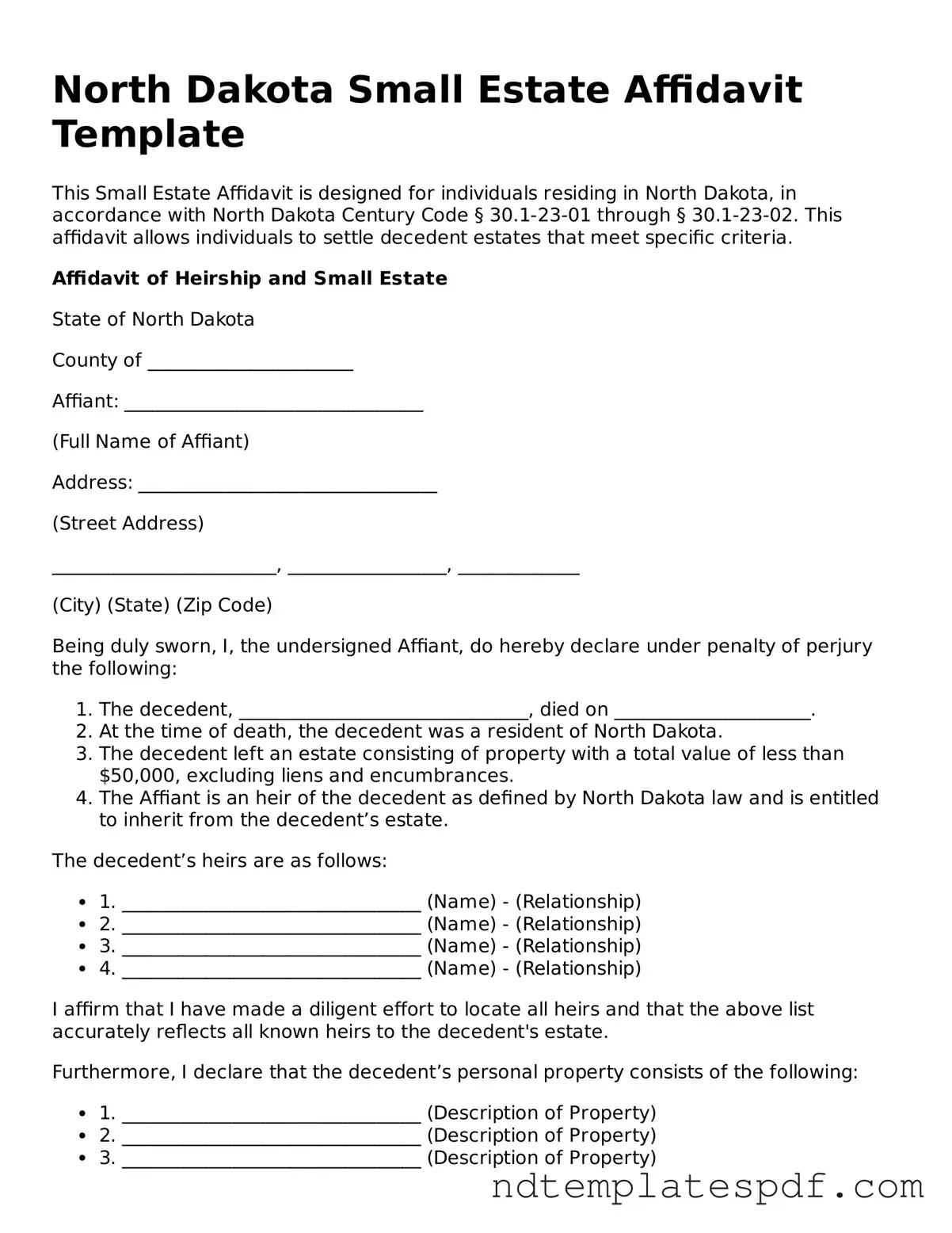

Legal North Dakota Small Estate Affidavit Document

The North Dakota Small Estate Affidavit is a legal document that allows individuals to claim assets from a deceased person's estate without going through the formal probate process. This form simplifies the transfer of property when the total value of the estate falls below a specified threshold. By using this affidavit, heirs can expedite the distribution of assets while minimizing costs and legal complexities.

Fill Out Document Now

Legal North Dakota Small Estate Affidavit Document

Fill Out Document Now

Fast-track this form

Finalize your Small Estate Affidavit online: edit, save, download in minutes.

Fill Out Document Now

or

➤ PDF