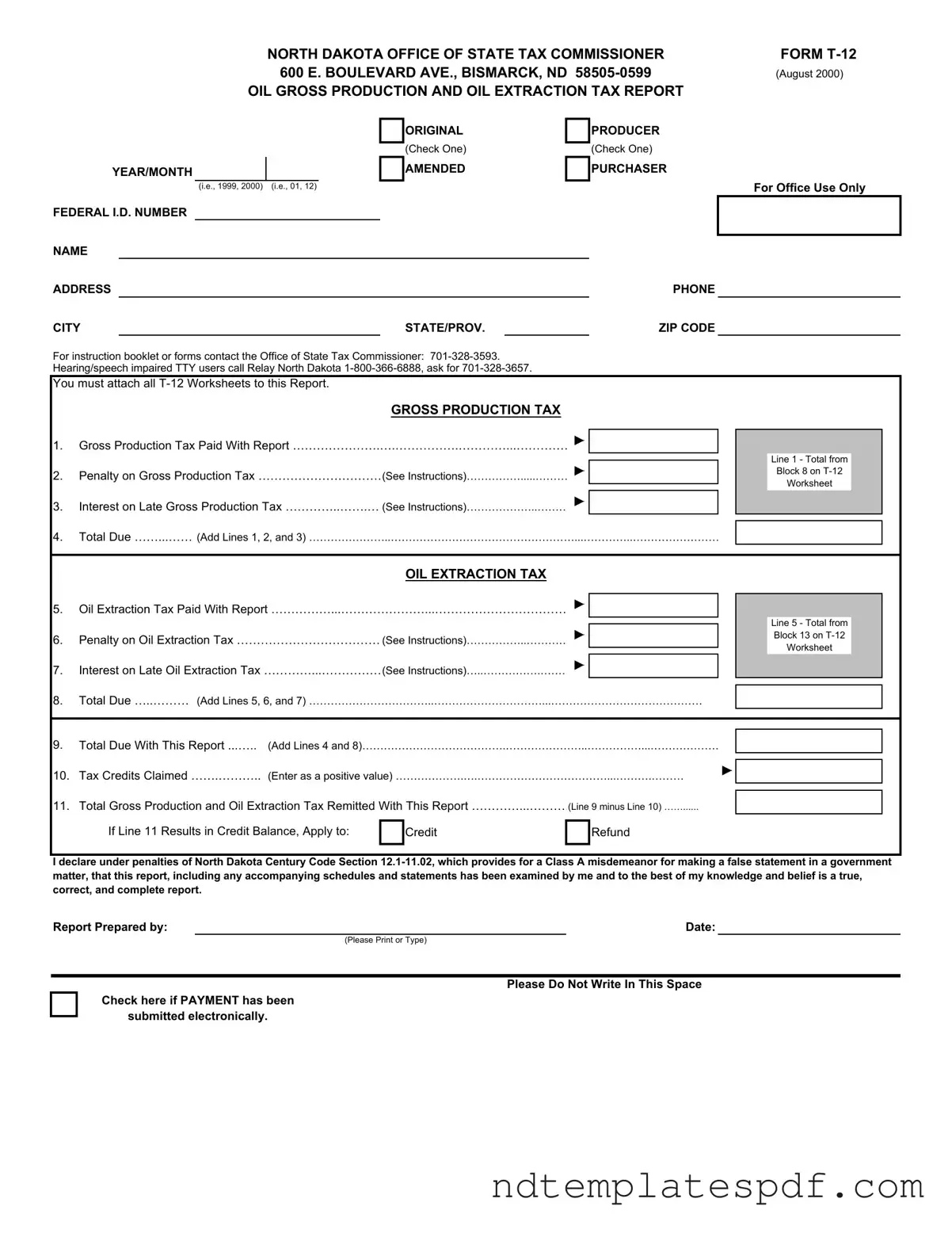

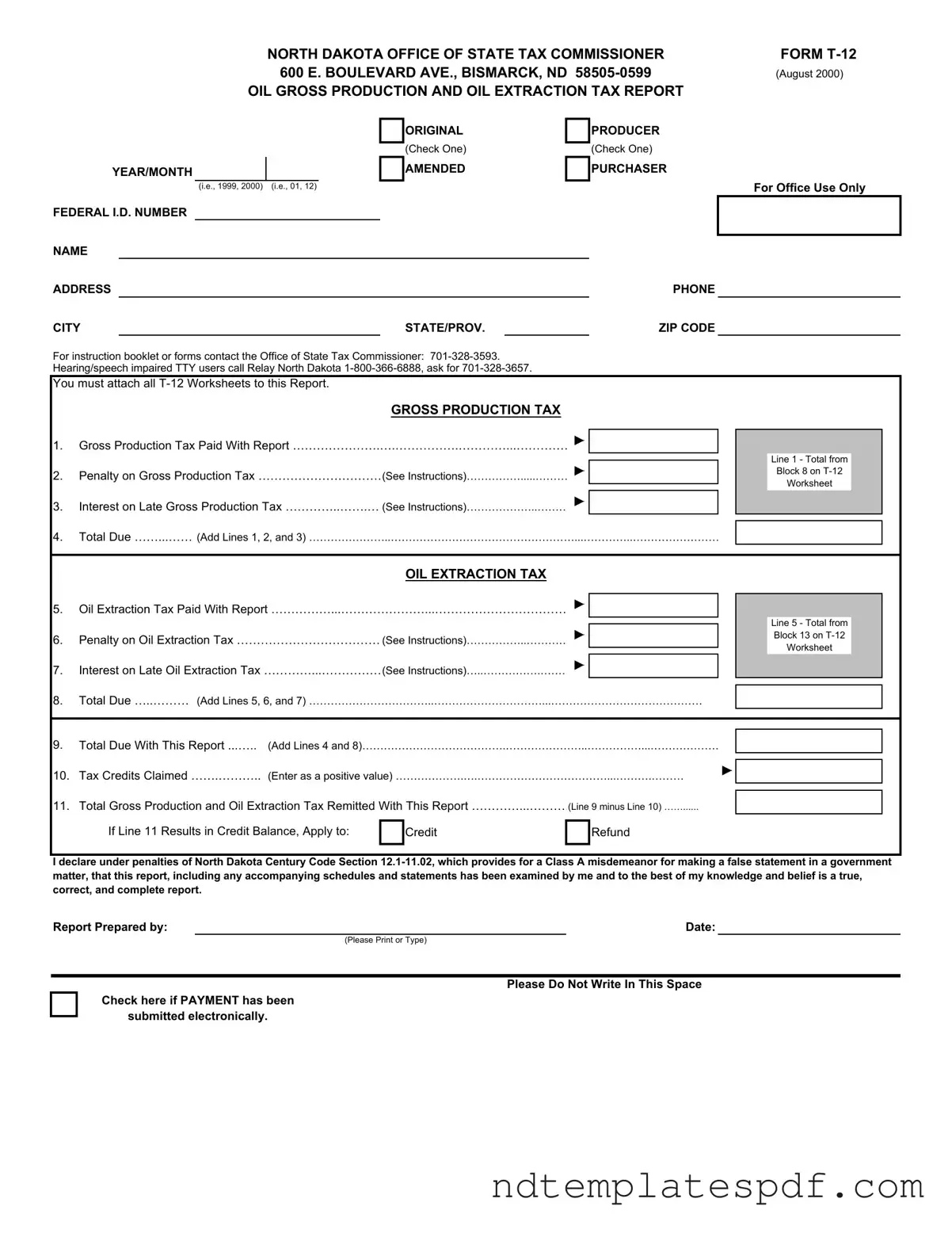

Free North Dakota T 12 PDF Form

The North Dakota T 12 form serves as the official report for oil gross production and oil extraction taxes. This essential document must be completed by producers and purchasers in the oil industry to ensure compliance with state tax regulations. Understanding its components and requirements is crucial for accurate reporting and timely submission.

Fill Out Document Now

Free North Dakota T 12 PDF Form

Fill Out Document Now

Fast-track this form

Finalize your North Dakota T 12 online: edit, save, download in minutes.

Fill Out Document Now

or

➤ PDF