Free North Dakota 58 PDF Form

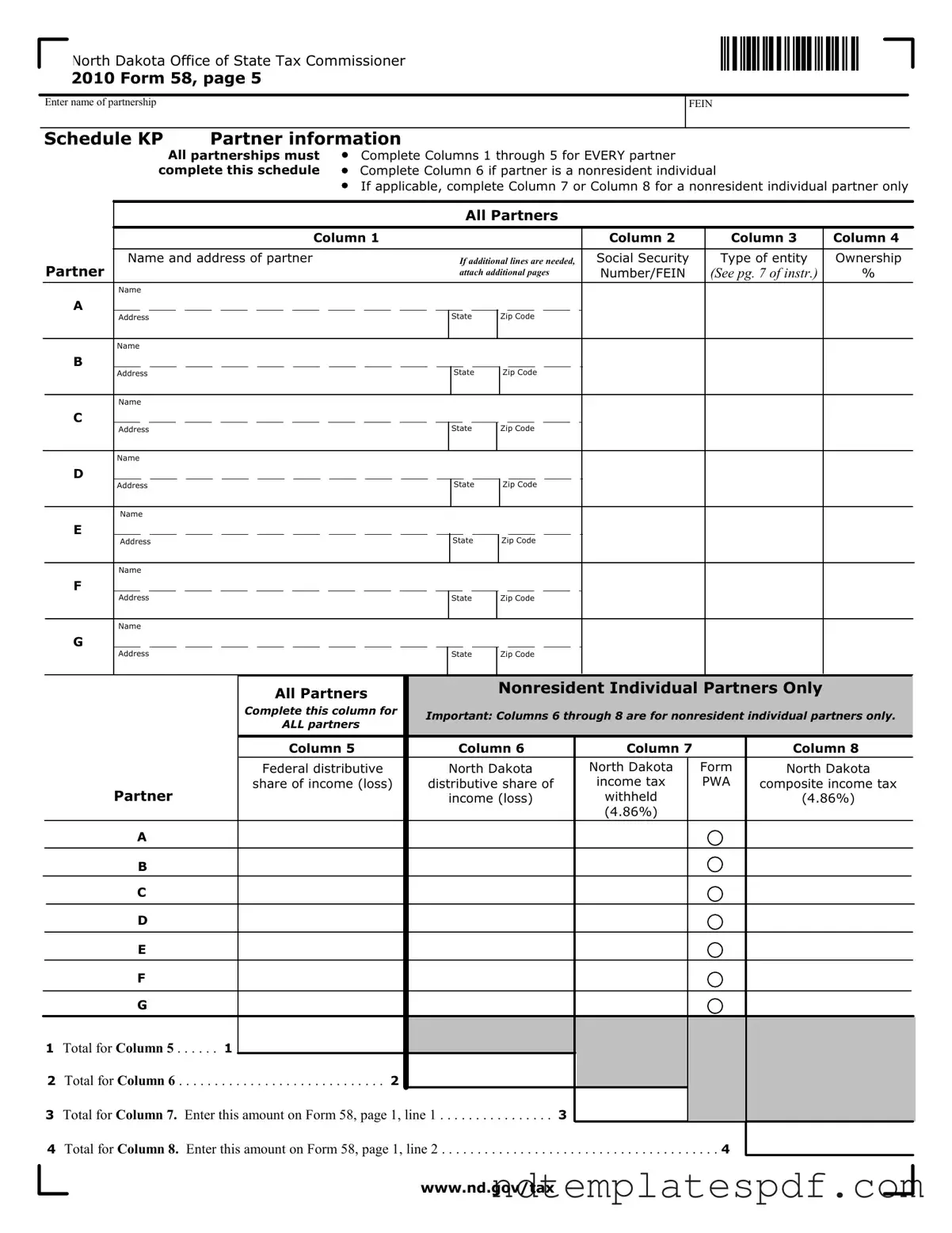

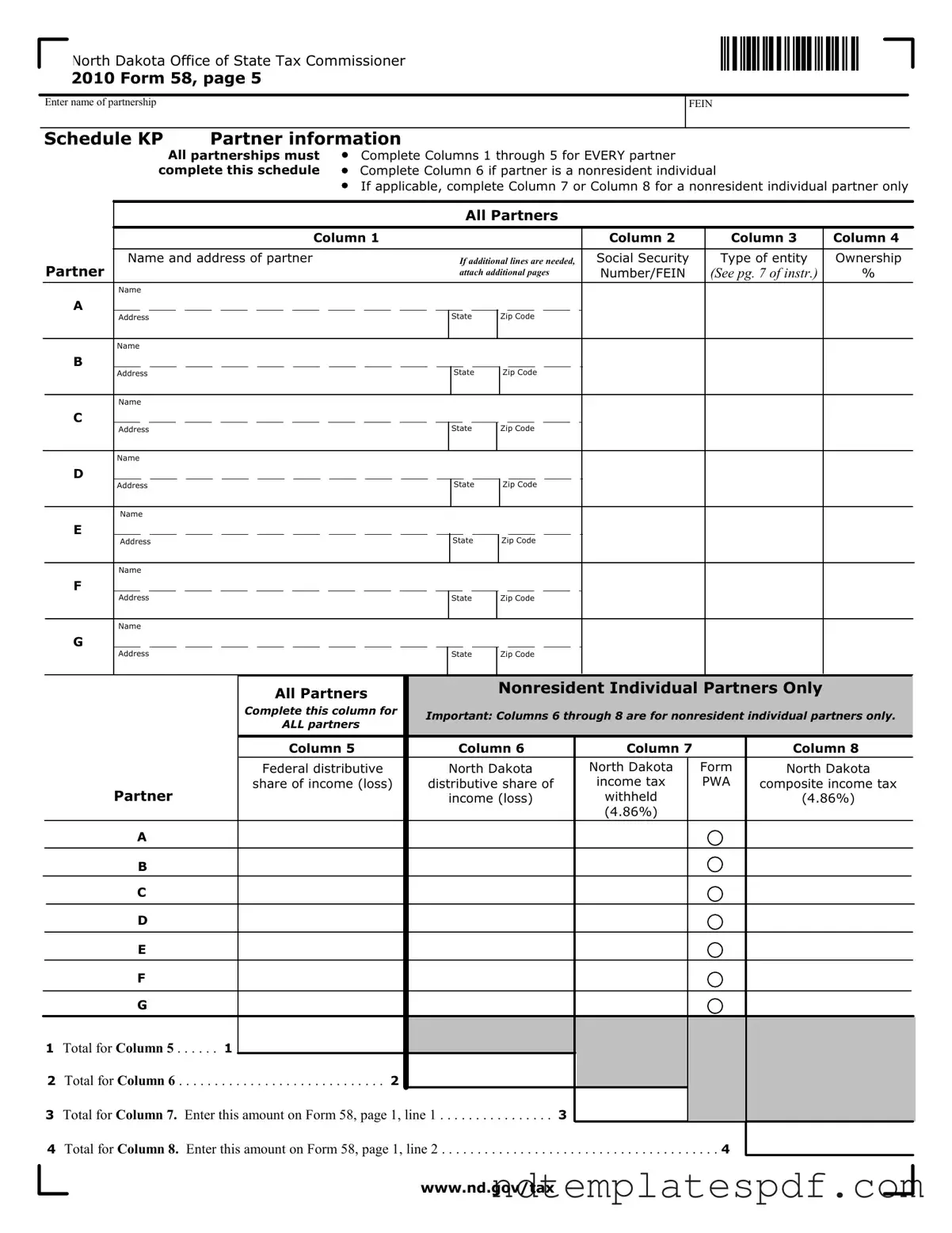

The North Dakota 58 form is a tax document used by partnerships to report income and partner information to the state tax authority. This form requires partnerships to provide details for each partner, including their names, addresses, and ownership percentages. Specific sections of the form are designated for nonresident individual partners, ensuring accurate tax withholding and reporting.

Fill Out Document Now

Free North Dakota 58 PDF Form

Fill Out Document Now

Fast-track this form

Finalize your North Dakota 58 online: edit, save, download in minutes.

Fill Out Document Now

or

➤ PDF