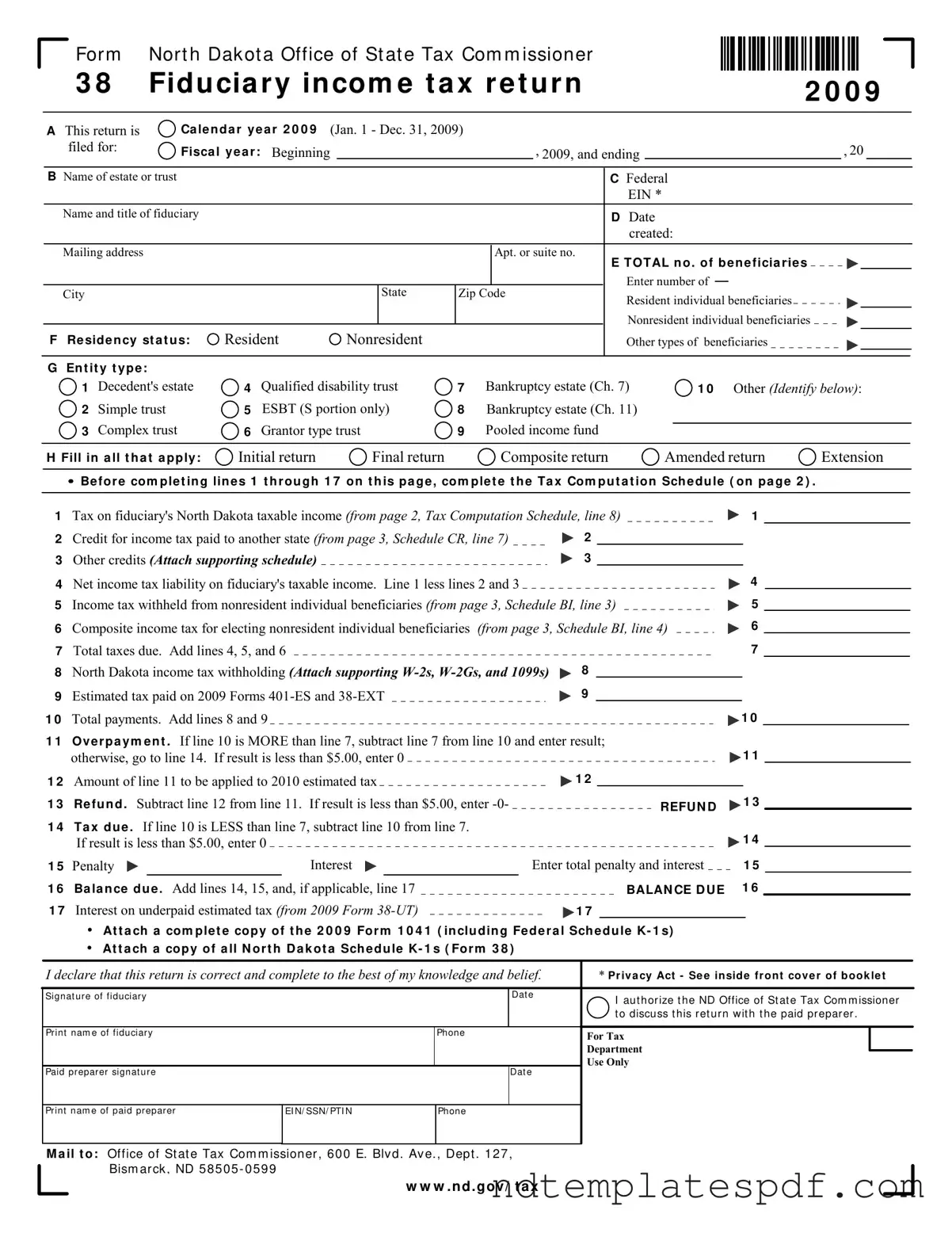

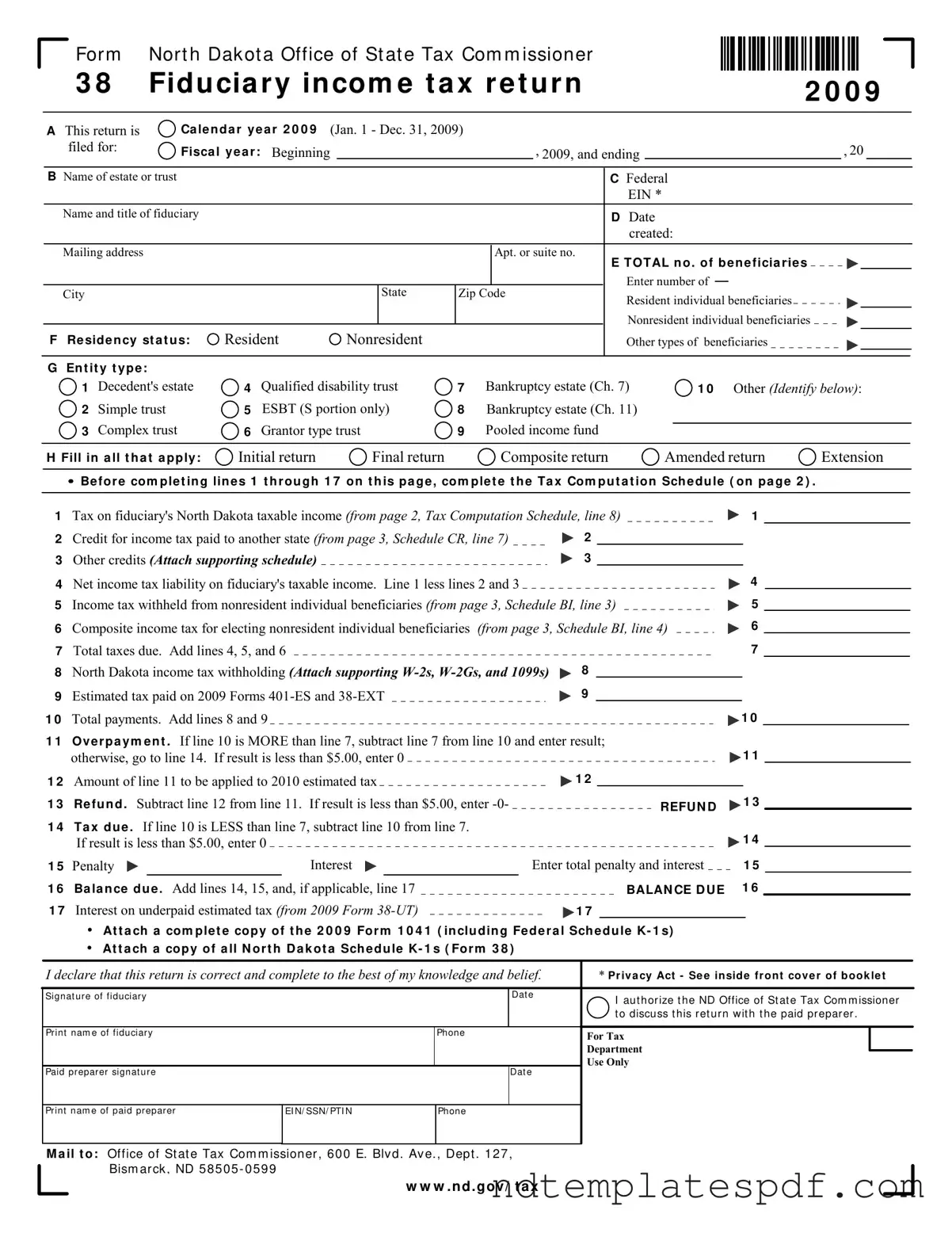

Free North Dakota 38 PDF Form

The North Dakota 38 form is a fiduciary income tax return used by estates and trusts to report their income and calculate tax liabilities for the state of North Dakota. This form is essential for ensuring that fiduciaries fulfill their tax obligations accurately and on time. By completing the North Dakota 38, fiduciaries can provide necessary information about the estate or trust's income, beneficiaries, and tax credits.

Fill Out Document Now

Free North Dakota 38 PDF Form

Fill Out Document Now

Fast-track this form

Finalize your North Dakota 38 online: edit, save, download in minutes.

Fill Out Document Now

or

➤ PDF