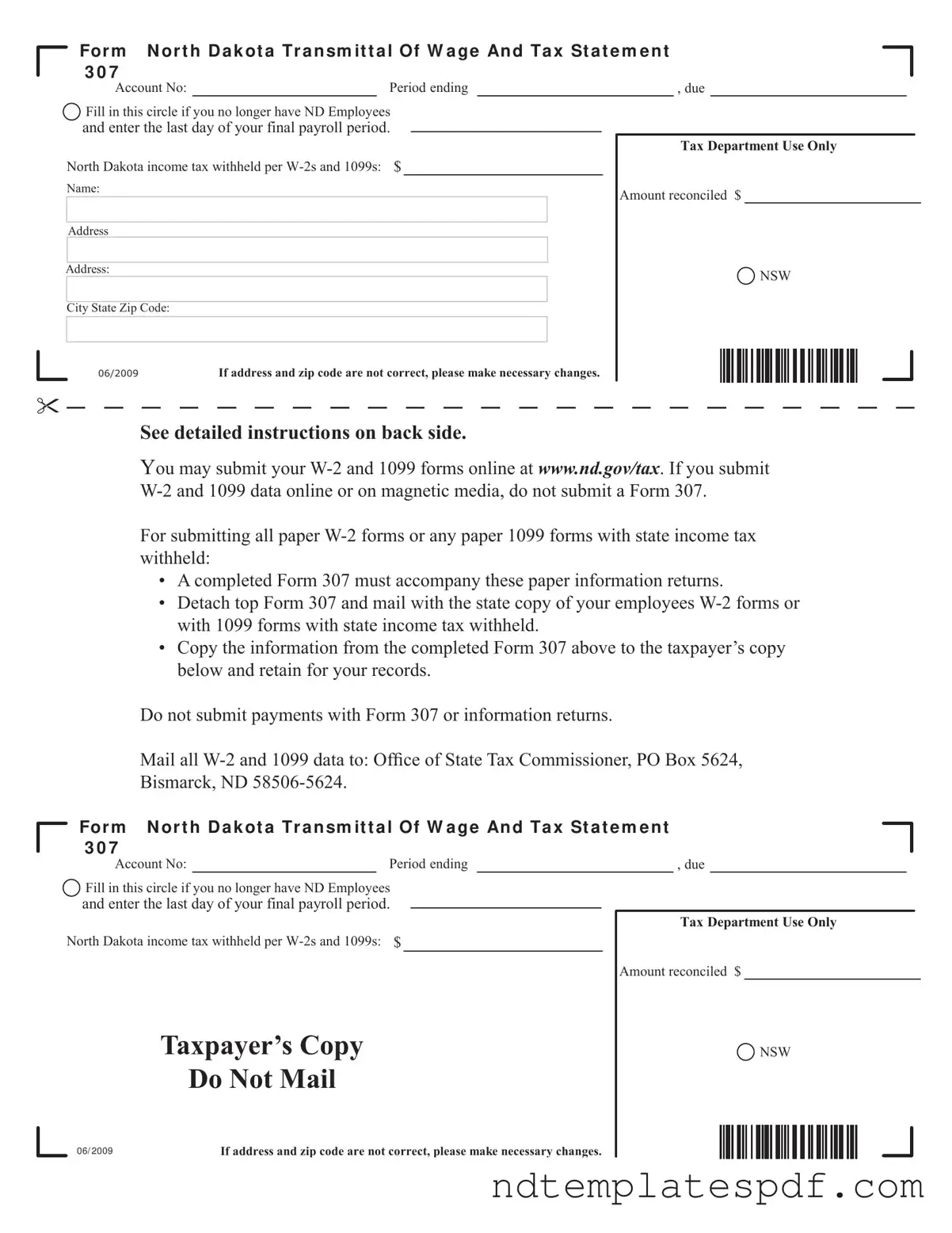

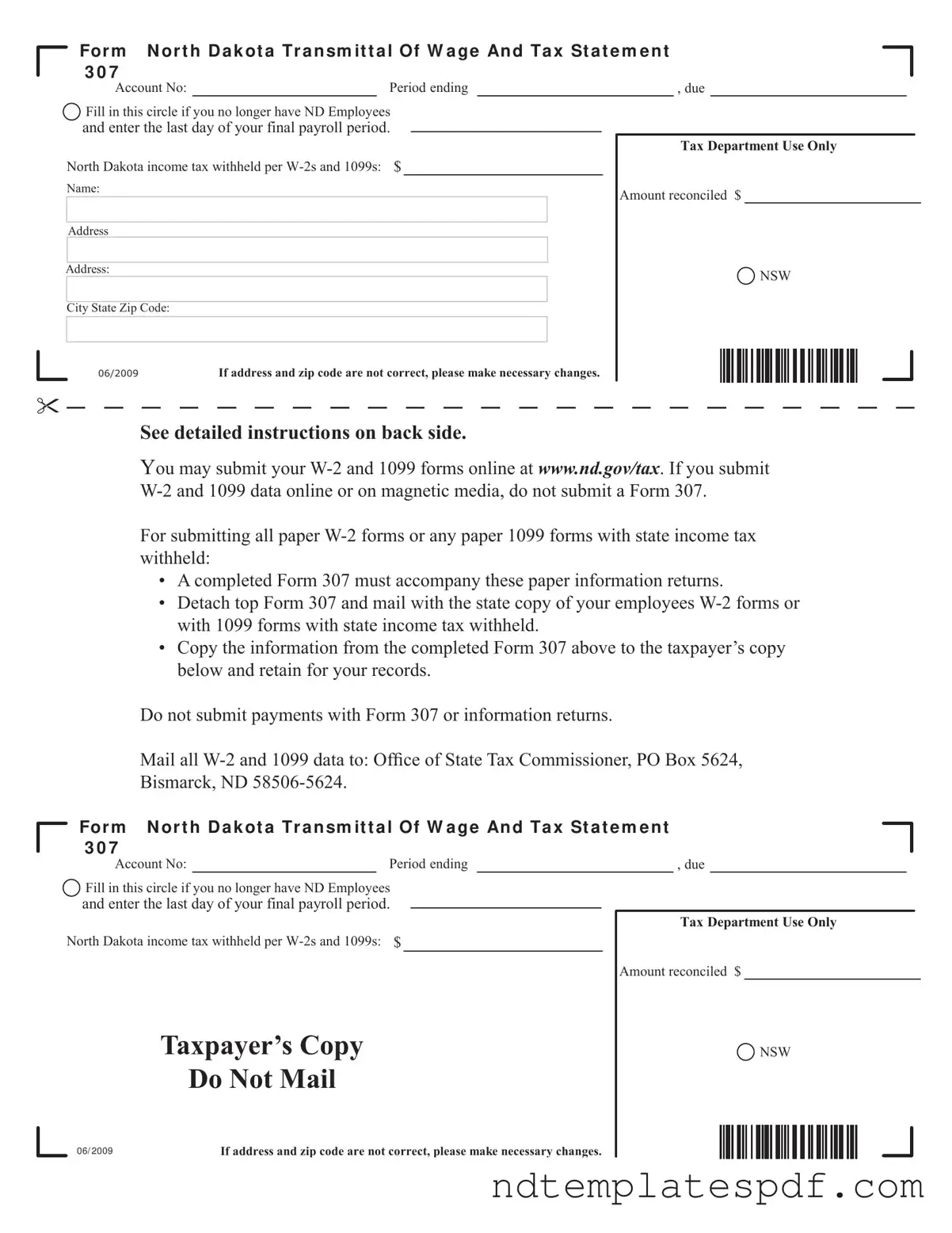

Free North Dakota 307 PDF Form

The North Dakota 307 form is a crucial document used by employers to report wage and tax information to the state. This form must accompany paper W-2 and 1099 submissions, ensuring compliance with North Dakota's income tax withholding laws. Understanding its requirements and deadlines is essential for employers, whether they are actively hiring or have ceased operations.

Fill Out Document Now

Free North Dakota 307 PDF Form

Fill Out Document Now

Fast-track this form

Finalize your North Dakota 307 online: edit, save, download in minutes.

Fill Out Document Now

or

➤ PDF