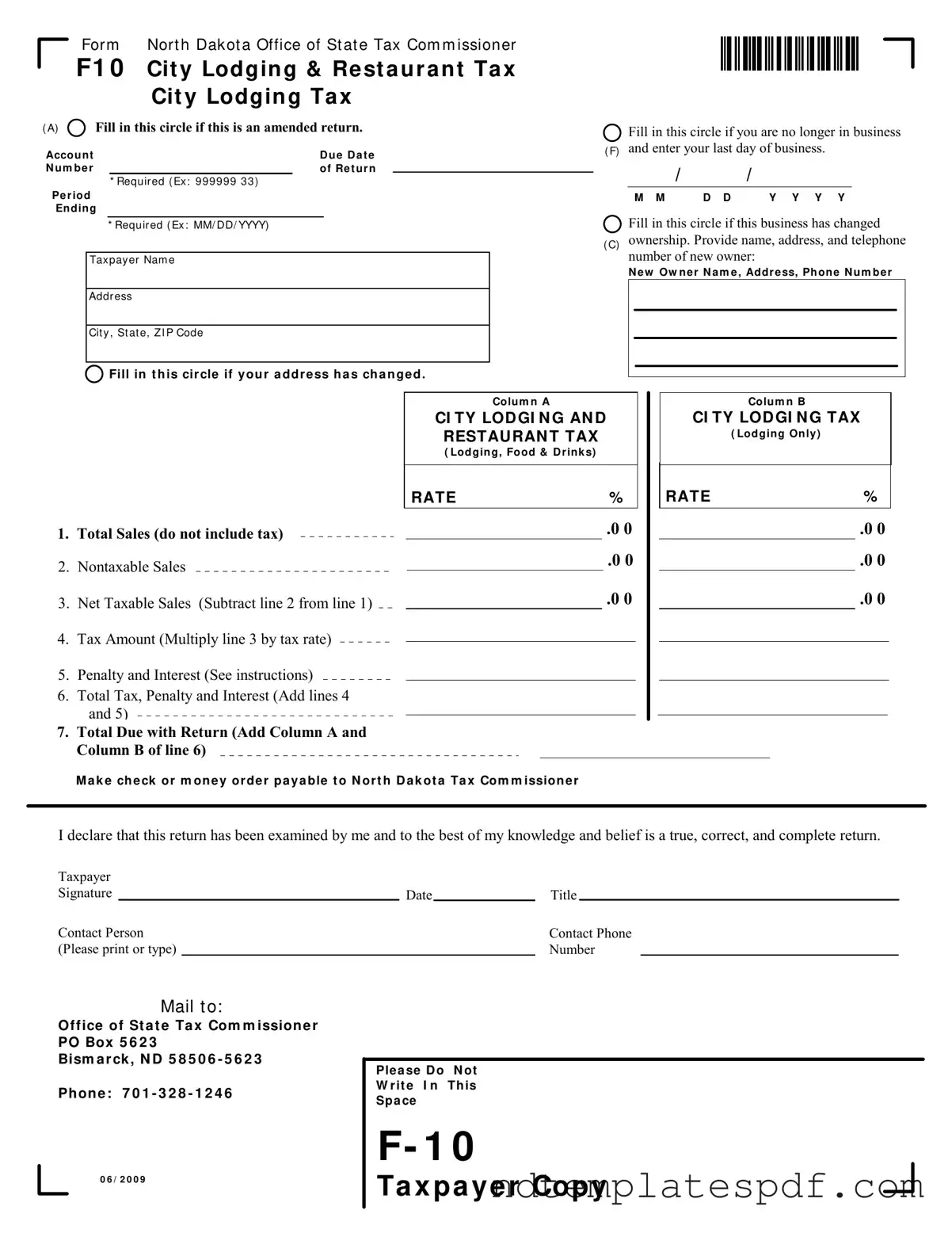

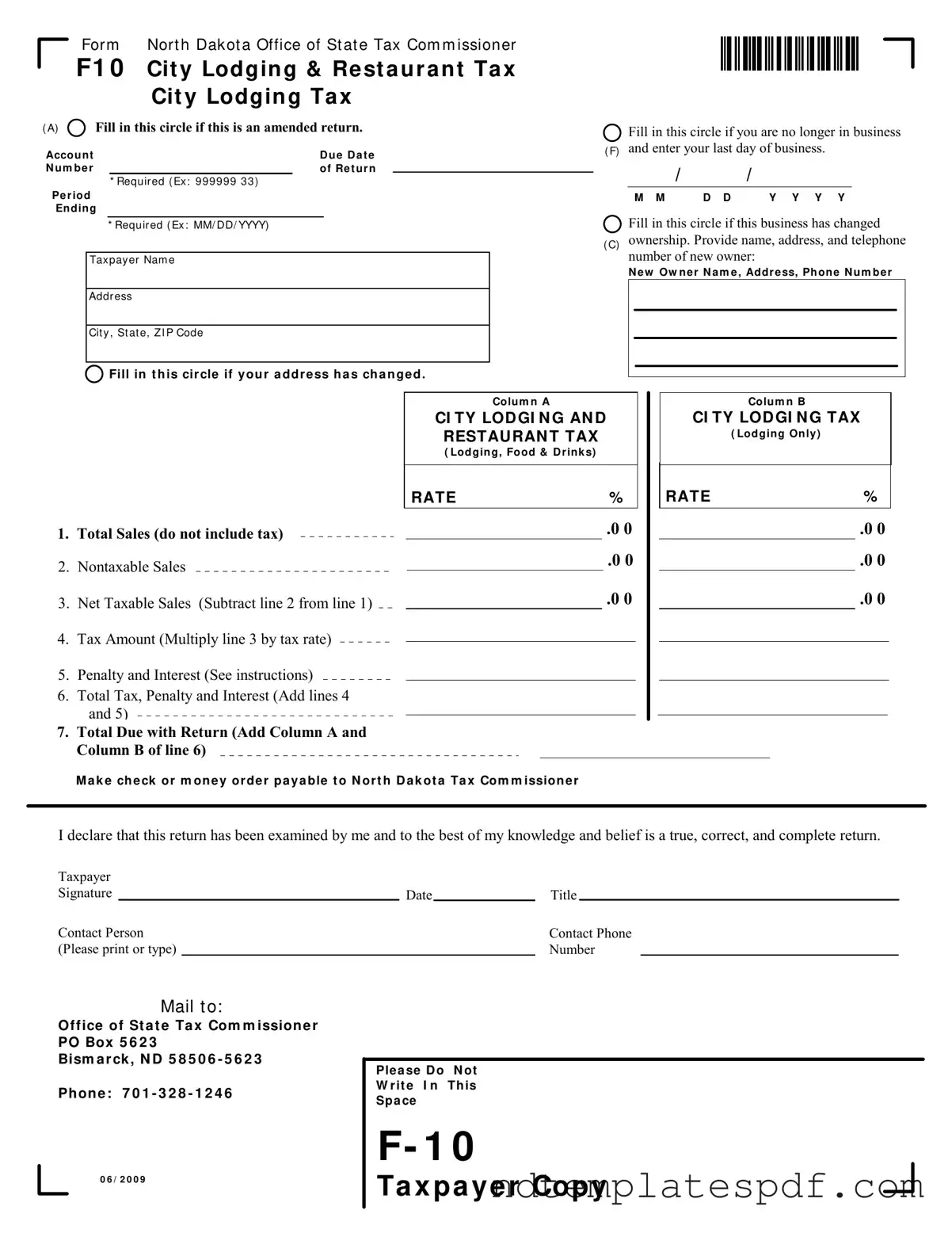

Free F10 North Dakota PDF Form

The F10 North Dakota form is a tax return used by businesses to report city lodging and restaurant taxes. This form is essential for ensuring compliance with state tax regulations, particularly for establishments that provide lodging or food services. Understanding how to accurately complete the F10 form can help prevent penalties and ensure that your business remains in good standing with the state.

Fill Out Document Now

Free F10 North Dakota PDF Form

Fill Out Document Now

Fast-track this form

Finalize your F10 North Dakota online: edit, save, download in minutes.

Fill Out Document Now

or

➤ PDF