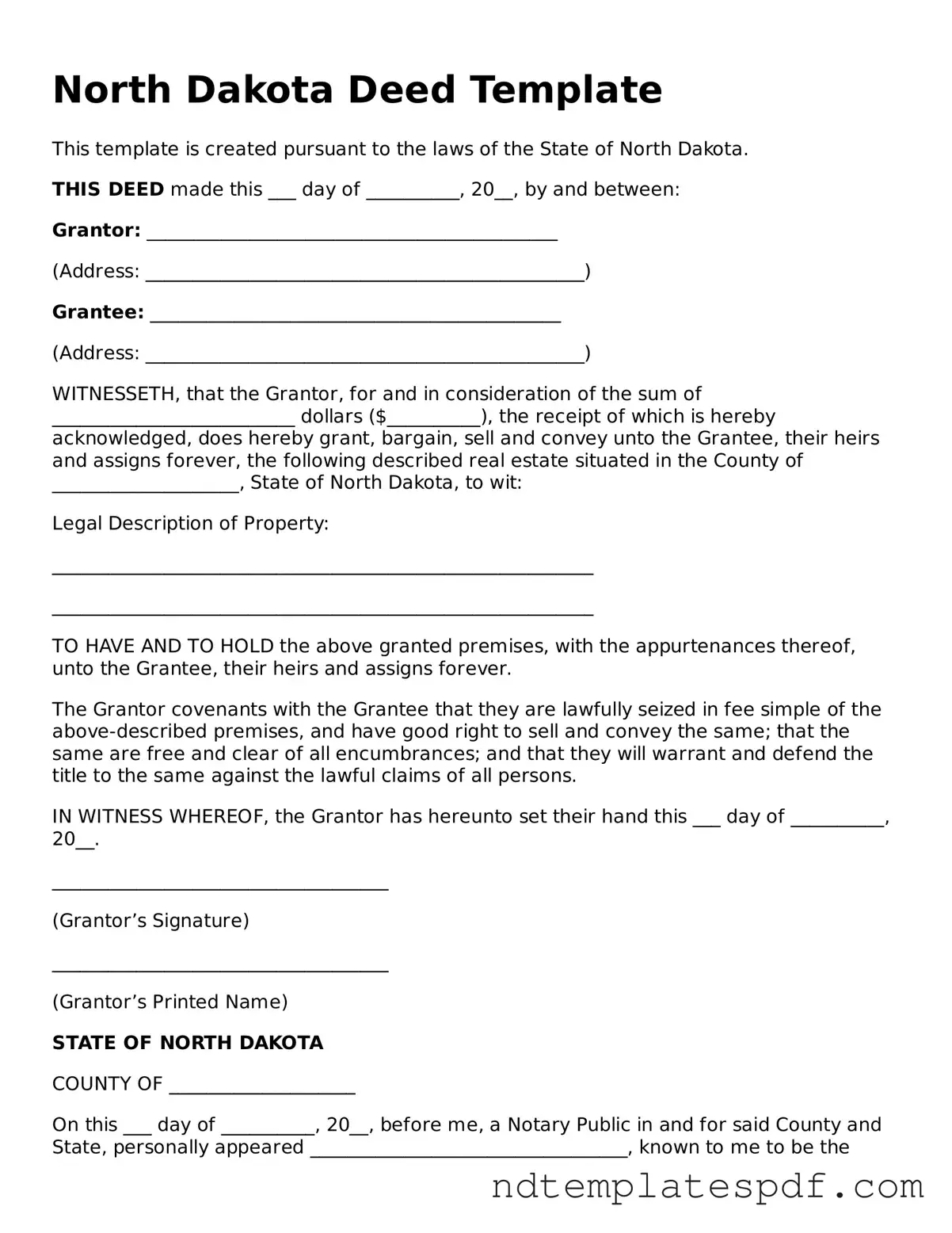

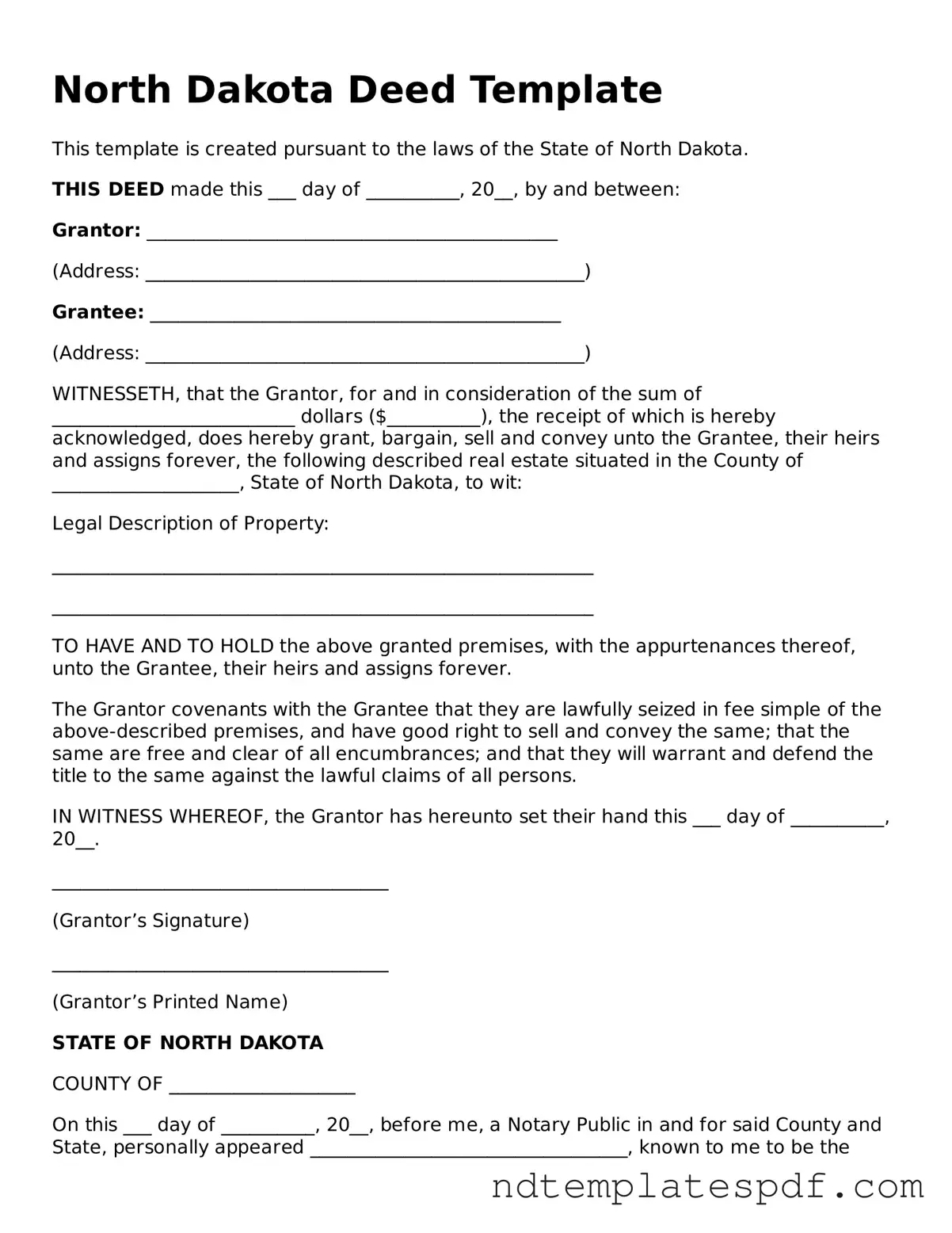

Legal North Dakota Deed Document

A North Dakota Deed form is a legal document that facilitates the transfer of property ownership from one party to another within the state. This essential tool ensures that the transaction is recorded and recognized by the appropriate authorities, providing clarity and security for both the buyer and seller. Understanding its components and requirements is crucial for anyone involved in real estate transactions in North Dakota.

Fill Out Document Now

Legal North Dakota Deed Document

Fill Out Document Now

Fast-track this form

Finalize your Deed online: edit, save, download in minutes.

Fill Out Document Now

or

➤ PDF